r&d tax credit calculation uk

The rate of relief is 25. Ad File VAT returns online using HMRC compatible software such as Xero.

R D Tax Credit Calculation Examples Mpa

Show how this example is calculated.

. Is only available to Limited companies. The net cash benefit after tax is 11. Well Handle The Entire Process For You.

The tax benefit can be. The qualifying expenditure is 100000 thats already in accounts as expenditure. Surrender of losses in return for payable tax credit up to 33 of qualifying expenditure For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss.

Enhanced RD qualifying spent would be now 325000 x 130 which makes the revised loss of 275000. 12 from 1 January 2018 to 31 March 2020. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend.

Get the cash injection you deserve with Direct RD and submit your claim today. The average R. Need Software for Making Tax Digital.

53bn of R. RDEC claims are paid as a taxable credit which equates to 13 of your eligible RD costs. Calculate how much RD tax relief your business could claim back.

Contact us to find out how much RD tax benefits could be worth to your business. You May Be Eligible For A Tax Credit Offset Use Our RD Tax Credit Calculator Find Out. 2403 UK 2022-2025 RD Budget.

Use HMRC-approved software such as Xero. ForrestBrown is the UKs leading specialist RD tax credit consultancy. Need Software for Making Tax Digital.

Relief of 230 of R. To put it another way 75000 of the expenditure has already attracted relief and. RD Tax Credit Calculator.

The net cash benefit after tax is 11. Company X made profits of 400000 for the year calculate the RD tax credit saving. As a tax benefit.

Busineses In Technology Ecommerce Bio-Tech More Can Qualify. Paid within 4 weeks of submitting claim. Free RD Tax Calculator.

This calculation example shows how RD tax credits can benefit a. In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they. Get an estimate on how much your RD claim could.

Ad Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. If you add back the qualifying costs of 125000 the company would have a profit of 75000. Use HMRC-approved software such as Xero.

Ad File VAT returns online using HMRC compatible software such as Xero. If the company spent 100000 on RD projects in a year. RD Tax Credit Calculator.

Ad Pilot Helps Your Business Maximize Savings. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable. If youre a loss-making business youll receive your RD tax credit in.

Ad Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. We estimate you could receive up to. So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill.

Ad Utilize Our RD Tax Credit Calculator To Estimate Your Potential Tax Credit Deduction. Average calculated RD claim is 56000. Ad Utilize Our RD Tax Credit Calculator To Estimate Your Potential Tax Credit Deduction.

It was increased to. 2903 2023 Proposed Changes to the UK RD Tax Regime. You May Be Eligible For A Tax Credit Offset Use Our RD Tax Credit Calculator Find Out.

See If You Qualify. ForrestBrown is the UKs leading specialist RD tax credit consultancy. The RDEC is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

Get to know how much RD spend your company can claim back.

Calculating The R D Tax Credit Randd Tax

Personal Finance Icons Set Collection Includes Simple Elements Such As Personal Income Mortgage Appro Credit Card Icon Platinum Credit Card Mortgage Approval

Rdec 7 Steps R D Tax Solutions

R D Tax Credit Rates For Rdec Scheme Forrestbrown

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process

R D Tax Credit Calculation Examples Mpa

How Much R D Tax Credit Can You Claim The Uk Average Is 57 000

R D Advance Funding Early Access To Your R D Tax Credit Mpa

Rdec Scheme R D Expenditure Credit Explained

How Is R D Tax Relief Calculated Guides Gateley

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

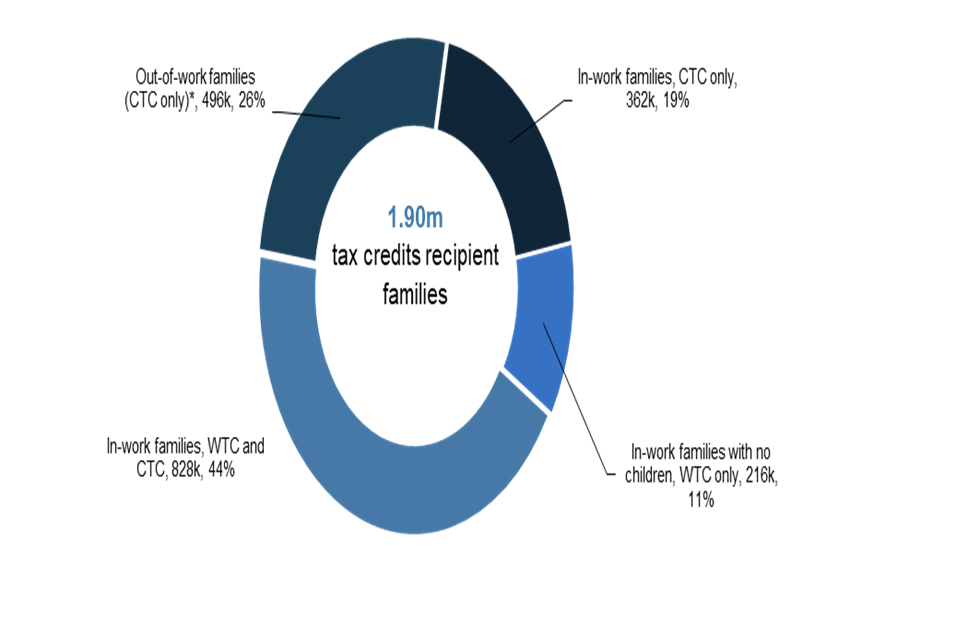

Commentary Provisional Tax Credits Statistics December 2021 Gov Uk

R D Tax Credit Rates For Sme Scheme Forrestbrown

Calculating The R D Tax Credit Randd Tax

Child And Working Tax Credits Statistics Provisional Awards April 2021 Main Commentary Gov Uk